by Calculated Risk on 4/23/2024 04:49:00 PM

Tuesday, April 23, 2024

The Normal Seasonal Pattern for Median House Prices

Last week, in the CalculatedRisk Real Estate Newsletter on March existing home sales, NAR: Existing-Home Sales Decreased to 4.19 million SAAR in March; Median House Prices Increased 4.8% Year-over-Year, I noted that median prices were up year-over-year (median prices are distorted by the mix).

Seasonally prices typically peak in June (closed sales are mostly for contracts signed in April and May).

And seasonally prices usually bottom the following January (contracts signed in November and December).

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|

| Jan to Mar | 3.7% | 4.1% | 5.4% | 7.5% | 7.1% | 4.0% | 3.9% |

| Mar to Jun | 9.6% | 9.9% | 4.9% | 12.4% | 9.1% | 9.3% | NA |

| Total Jan to Jun | 13.7% | 14.4% | 10.6% | 20.8% | 16.8% | 13.7% | NA |

| Jun to Dec | -7.0% | -3.8% | 5.0% | -2.2% | -11.4% | -7.0% | NA |

The 2024 increase in median prices from January to March was about the same as in 2018 and 2019.

New Home Sales Increase to 693,000 Annual Rate in March; Median New Home Price is Down 13% from the Peak

by Calculated Risk on 4/23/2024 10:40:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Increase to 693,000 Annual Rate in March

Brief excerpt:

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 693 thousand. The previous three months were revised down combined.There is much more in the article.

...

The next graph shows new home sales for 2023 and 2024 by month (Seasonally Adjusted Annual Rate). Sales in March 2024 were up 8.3% from March 2023.

...

Note that the median and average price are down due to the mix of homes sold, not because of large price declines. Homebuilders are building less expensive homes to keep up volumes.

New Home Sales Increase to 693,000 Annual Rate in March

by Calculated Risk on 4/23/2024 10:00:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 693 thousand.

The previous three months were revised down combined.

Sales of new single‐family houses in March 2024 were at a seasonally adjusted annual rate of 693,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 8.8 percent above the revised February rate of 637,000 and is 8.3 percent above the March 2023 estimate of 640,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were close to pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply decreased in March to 8.3 months from 8.8 months in February.

The months of supply decreased in March to 8.3 months from 8.8 months in February. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of March was 477,000. This represents a supply of 8.3 months at the current sales rate."Sales were above expectations of 670 thousand SAAR, however, sales for the three previous months were revised down, combined. I'll have more later today.

Monday, April 22, 2024

Tuesday: New Home Sales

by Calculated Risk on 4/22/2024 08:08:00 PM

Mortgage rates began the new week at almost exactly the same levels seen at the end of last week. There were no major events or economic reports to cause volatility in the underlying bond market, but bonds were able to improve modestly by the end of the day.Tuesday:

...

By staying near Friday's levels, the average lender is just shy of the highest rates in 5 months. A top tier conventional 30yr fixed scenario is still in the mid 7% range. [30 year fixed 7.43%]

emphasis added

• At 10:00 AM ET, New Home Sales for March from the Census Bureau. The consensus is for 670 thousand SAAR, up from 662 thousand in February.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for April.

MBA Survey: Share of Mortgage Loans in Forbearance Holds Steady at 0.22% in March

by Calculated Risk on 4/22/2024 04:13:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Remains at 0.22% in March

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance remained unchanged at 0.22% as of March 31, 2024. According to MBA’s estimate, 110,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.1 million borrowers since March 2020.At the end of February, there were about 110,000 homeowners in forbearance plans.

In March 2024, the share of Fannie Mae and Freddie Mac loans in forbearance remained at 0.12%. Ginnie Mae loans in forbearance stayed at 0.40%, and the forbearance share for portfolio loans and private-label securities (PLS) increased 2 basis points to 0.31%.

“For the past three months, the number of loans in forbearance has held steady,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The current labor market is showing resilience, minimizing the need for mortgage forbearance. However, life events and temporary hardships still happen, regardless of employment conditions, which may explain why we have reached a floor in the forbearance rate.”

emphasis added

Housing April 22nd Weekly Update: Inventory up 3.0% Week-over-week, Up 30.9% Year-over-year

by Calculated Risk on 4/22/2024 02:58:00 PM

Click on graph for larger image.

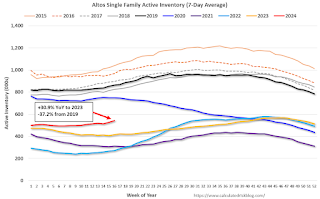

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

TSA: Airline Travel about 5% Above 2019 Levels

by Calculated Risk on 4/22/2024 10:52:00 AM

The TSA is providing daily travel numbers.

This data is as of April 21st.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA (Blue).

The red line is the percent of 2019 for the seven-day average.

Air travel - as a percent of 2019 - is tracking at about 105% of pre-pandemic levels.

DOT: Vehicle Miles Driven Increased 1.4% year-over-year in February 2024 SA

by Calculated Risk on 4/22/2024 08:14:00 AM

This is something I check occasionally.

The Department of Transportation (DOT) reported:

• Travel on all roads and streets changed by +2.0% (+4.8 billion vehicle miles) for February 2024 as compared with February 2023. Travel for the month is estimated to be 240.2 billion vehicle miles.

• The seasonally adjusted vehicle miles traveled for February 2024 is 274.8 billion miles, a +1.4% ( +3.9 billion vehicle miles) change over February 2023. It also represents a 0.6% change (1.7 billion vehicle miles) compared with January 2024.

• Cumulative Travel for 2024 changed by +0.6% (+2.7 billion vehicle miles). The cumulative estimate for the year is 487.4 billion vehicle miles of travel.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly total vehicle miles driven, seasonally adjusted.

Miles driven declined sharply in March 2020, and really collapsed in April 2020. Miles driven are now at pre-pandemic levels.

Sunday, April 21, 2024

Sunday Night Futures

by Calculated Risk on 4/21/2024 07:14:00 PM

Weekend:

• Schedule for Week of April 21, 2024

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for March. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 17 and DOW futures are up 100 (fair value).

Oil prices were up over the last week with WTI futures at $83.26 per barrel and Brent at $86.96 per barrel. A year ago, WTI was at $78, and Brent was at $83 - so WTI oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.64 per gallon. A year ago, prices were at $3.67 per gallon, so gasoline prices are down $0.03 year-over-year.

When Do Market Participants Expect the Fed to Cut Rates?

by Calculated Risk on 4/21/2024 09:40:00 AM

As of December 2023, looking at the "dot plot", most FOMC participants expected between 2 and 4 rate cuts in 2024:

| As of Dec 2023 Meeting | |

|---|---|

| 25 bp Rate Cuts | FOMC Members |

| No Change | 2 |

| One Rate Cut | 1 |

| Two Rate Cuts | 5 |

| Three Rate Cuts | 6 |

| Four Rate Cuts | 4 |

| More than Four | 1 |

As of the March 2024 meeting, FOMC participants were down to 2 to 3 rate cuts in 2024:

| As of Mar 2024 Meeting | |

|---|---|

| 25 bp Rate Cuts | FOMC Members |

| No Change | 2 |

| One Rate Cut | 2 |

| Two Rate Cuts | 5 |

| Three Rate Cuts | 9 |

| Four Rate Cuts | 1 |

Most market participants expect between 1 and 2 rate cuts this year, with the first cut in September. Here are a couple analyst views:

[W]e revised our Fed forecasts in response to the upside surprise in the March inflation data. We now expect the Fed to start cutting in December rather than June, and we still think cuts will proceed at a quarterly cadence. Importantly, we did not simply push our projected cutting cycle out by two quarters. We removed the June and September 2024 cuts entirely from our forecast, raising the terminal rate by 50bp to 3.5-3.75%.From Goldman Sachs:

The FOMC was already narrowly divided on its three-cut baseline for 2024, and we think it will now need to see the string of three firmer inflation prints from January to March balanced by a series of softer prints in subsequent months.

We continue to expect cuts at a quarterly pace after July, which now implies two cuts in 2024 in July and November.