by Calculated Risk on 4/18/2024 06:11:00 PM

Thursday, April 18, 2024

Hotels: Occupancy Rate Increased 2.8% Year-over-year

Helped by the total solar eclipse, U.S. hotel performance increased from the previous week, according to CoStar’s latest data through 13 April. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

7-13 April 2024 (percentage change from comparable week in 2023):

• Occupancy: 65.8% (+2.8%)

• Average daily rate (ADR): US$160.20 (+2.9%)

• Revenue per available room (RevPAR): US$105.48 (+5.8%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Realtor.com Reports Active Inventory UP 29.1% YoY; New Listings Up 7.2% YoY

by Calculated Risk on 4/18/2024 02:01:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For March, Realtor.com reported inventory was up 23.5% YoY, but still down almost 38% compared to March 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data Week Ending April 13, 2024

• Active inventory increased, with for-sale homes 29.1% above year-ago levels.

For the 23rd week in a row, there were more homes listed for sale compared with the previous year, giving homebuyers a wider selection to choose from. However, this week’s increase was not as high as the 30.4% growth seen last week, possibly suggesting a slowdown in inventory growth. This could be due to the continued impact of high mortgage rates, which might be discouraging some sellers from listing their homes.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 7.2% from one year ago.

Following some ups and downs around Easter, sellers kept putting homes on the market at a faster rate compared with last year, with a 7.2% increase in newly listed homes. However, this growth rate is slower than what we’ve seen since early February.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 23rd consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

NAR: Existing-Home Sales Decreased to 4.19 million SAAR in March; Median House Prices Increased 4.8% Year-over-Year

by Calculated Risk on 4/18/2024 10:40:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.19 million SAAR in March

Excerpt:

Sales Year-over-Year and Not Seasonally Adjusted (NSA)There is much more in the article.

The fourth graph shows existing home sales by month for 2023 and 2024.

Sales declined 3.7% year-over-year compared to March 2023. This was the thirty-first consecutive month with sales down year-over-year.

NAR: Existing-Home Sales Decreased to 4.19 million SAAR in March

by Calculated Risk on 4/18/2024 10:00:00 AM

From the NAR: Existing-Home Sales Descended 4.3% in March

Existing-home sales slipped in March, according to the National Association of REALTORS®. Among the four major U.S. regions, sales slid in the Midwest, South and West, but rose in the Northeast for the first time since November 2023. Year-over-year, sales decreased in all regions.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – receded 4.3% from February to a seasonally adjusted annual rate of 4.19 million in March. Year-over-year, sales waned 3.7% (down from 4.35 million in March 2023).

...

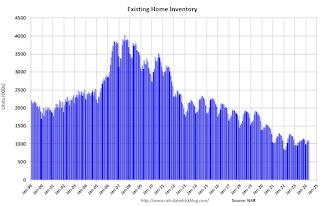

Total housing inventory registered at the end of March was 1.11 million units, up 4.7% from February and 14.4% from one year ago (970,000). Unsold inventory sits at a 3.2-month supply at the current sales pace, up from 2.9 months in February and 2.7 months in March 2023.

emphasis added

Click on graph for larger image.

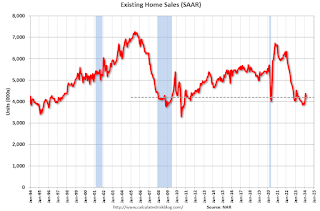

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in March (4.19 million SAAR) were down 4.3% from the previous month and were 3.7% below the March 2023 sales rate.

According to the NAR, inventory increased to 1.11 million in March from 1.06 million the previous month.

According to the NAR, inventory increased to 1.11 million in March from 1.06 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 14.4% year-over-year (blue) in March compared to March 2023.

Inventory was up 14.4% year-over-year (blue) in March compared to March 2023. Months of supply (red) increased to 3.2 months in March from 2.9 months the previous month.

This was at the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims Unchanged at 212,000

by Calculated Risk on 4/18/2024 08:30:00 AM

The DOL reported:

In the week ending April 13, the advance figure for seasonally adjusted initial claims was 212,000, unchanged from the previous week's revised level. The previous week's level was revised up by 1,000 from 211,000 to 212,000. The 4-week moving average was 214,500, unchanged from the previous week's revised average. The previous week's average was revised up by 250 from 214,250 to 214,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 214,500.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Wednesday, April 17, 2024

Thursday: Unemployment Claims, Philly Fed Mfg, Existing Home Sales

by Calculated Risk on 4/17/2024 08:23:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 211 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of 0.0, down from 3.2.

• At 10:00 AM, Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 4.20 million SAAR, down from 4.38 million.

4th Look at Local Housing Markets in March; California Home Sales Down 4.4% YoY in March

by Calculated Risk on 4/17/2024 04:21:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in March; California Home Sales Down 4.4% YoY in March

A brief excerpt:

The NAR is scheduled to release March existing home sales tomorrow, Thursday, April 18th at 10:00AM ET. The consensus is for 4.20 million SAAR, down from 4.38 million in February.There is much more in the article.

Housing economist Tom Lawler expects the NAR to report sales of 4.23 million SAAR for March.

...

And a table of March sales.

In March, sales in these markets were down 9.7% YoY. In February, these same markets were up 1.6% year-over-year Not Seasonally Adjusted (NSA).

Sales in most of these markets are down compared to 2019.

This is a year-over-year decrease NSA for these early reporting markets. However, there were two fewer working days in March 2024 compared to March 2023, so sales Seasonally Adjusted will be higher year-over-year than Not Seasonally Adjusted sales.

...

More local markets will release data after the NAR release tomorrow!

Fed's Beige Book: "Economic activity expanded slightly"

by Calculated Risk on 4/17/2024 02:00:00 PM

Overall economic activity expanded slightly, on balance, since late February. Ten out of twelve Districts experienced either slight or modest economic growth—up from eight in the previous report, while the other two reported no changes in activity. Consumer spending barely increased overall, but reports were quite mixed across Districts and spending categories. Several reports mentioned weakness in discretionary spending, as consumers' price sensitivity remained elevated. Auto spending was buoyed notably in some Districts by improved inventories and dealer incentives, but sales remained sluggish in other Districts. Tourism activity increased modestly, on average, but reports varied widely. Manufacturing activity declined slightly, as only three Districts reported growth in that sector. Contacts reported slight increases in nonfinancial services activity, on average, and bank lending was roughly flat overall. Residential construction increased a little, on average, and home sales strengthened in most Districts. In contrast, nonresidential construction was flat, and commercial real estate leasing fell slightly. The economic outlook among contacts was cautiously optimistic, on balance.

Labor Markets

Employment rose at a slight pace overall, with nine Districts reporting very slow to modest increases, and the remaining three Districts reporting no changes in employment. Most Districts noted increases in labor supply and in the quality of job applicants. Several Districts reported improved retention of employees, and others pointed to staff reductions at some firms. Despite the improvements in labor supply, many Districts described persistent shortages of qualified applicants for certain positions, including machinists, trades workers, and hospitality workers. Wages grew at a moderate pace in eight Districts, with the remaining four noting only slight to modest wage increases. Multiple Districts said that annual wage growth rates had recently returned to their historical averages. On balance, contacts expected that labor demand and supply would remain relatively stable, with modest further job gains and continued moderation of wage growth back to pre-pandemic levels.

Prices

Price increases were modest, on average, running at about the same pace as in the last report. Disruptions in the Red Sea and the collapse of Baltimore's Key Bridge caused some shipping delays but so far did not lead to widespread price increases.

emphasis added

LA Port Traffic Increased Year-over-year in March

by Calculated Risk on 4/17/2024 01:41:00 PM

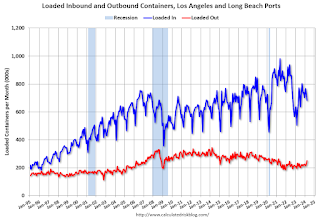

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic increased 1.0% in March compared to the rolling 12 months ending in February. Outbound traffic increased 0.7% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year. MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 4/17/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 12, 2024.

The Market Composite Index, a measure of mortgage loan application volume, increased 3.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 4 percent compared with the previous week. The Refinance Index increased 0.5 percent from the previous week and was 11 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 10 percent lower than the same week one year ago.

“Rates increased for the second consecutive week, driven by incoming data indicating that the economy remains strong and inflation is proving tougher to bring down. Mortgage rates increased across the board, with the 30-year fixed rate at 7.13 percent – reaching its highest level since December 2023,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Despite these higher rates, application activity picked up, possibly as some borrowers decided to act in case rates continue to rise. Purchase applications drove most of the increase, but remain at low levels of around 10 percent behind last year’s pace. Refinance applications increased very slightly, driven by a 3 percent gain in conventional applications.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 7.13 percent from 7.01 percent, with points increasing to 0.65 from 0.59 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 10% year-over-year unadjusted.