by Calculated Risk on 4/16/2024 10:17:00 AM

Tuesday, April 16, 2024

Single Family Starts Up 22% Year-over-year in March; Multi-Family Starts Down Sharply

Today, in the Calculated Risk Real Estate Newsletter: Single Family Starts Up 22% Year-over-year in March; Multi-Family Starts Down Sharply

A brief excerpt:

Total housing starts in March were well below expectations, however, starts in January and February were revised up.

The third graph shows the month-to-month comparison for total starts between 2023 (blue) and 2024 (red).

Total starts were down 4.3% in March compared to March 2023.

Starts were down year-over-year (YoY) in March following 4 consecutive months with starts up YoY. The YoY decline is due to the sharp decrease in multi-family starts.

Industrial Production Increased 0.4% in March

by Calculated Risk on 4/16/2024 09:15:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 0.4 percent in March but declined at an annual rate of 1.8 percent in the first quarter. Manufacturing output increased 0.5 percent in March, boosted in part by a gain of 3.1 percent in motor vehicles and parts; factory output excluding motor vehicles and parts moved up 0.3 percent. The index for mining fell 1.4 percent, and the index for utilities gained 2 percent. At 102.7 percent of its 2017 average, total industrial production in March was unchanged compared with its year-earlier level. Capacity utilization moved up to 78.4 percent in March, a rate that is 1.2 percentage points below its long-run (1972–2023) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.4% is 1.2% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.7. This is above the pre-pandemic level.

Industrial production was at consensus expectations.

Housing Starts Decreased to 1.321 million Annual Rate in March

by Calculated Risk on 4/16/2024 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in March were at a seasonally adjusted annual rate of 1,321,000. This is 14.7 percent below the revised February estimate of 1,549,000 and is 4.3 percent below the March 2023 rate of 1,380,000. Single‐family housing starts in March were at a rate of 1,022,000; this is 12.4 percent below the revised February figure of 1,167,000. The March rate for units in buildings with five units or more was 290,000.

Building Permits:

Privately‐owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,458,000. This is 4.3 percent below the revised February rate of 1,523,000, but is 1.5 percent above the March 2023 rate of 1,437,000. Single‐family authorizations in March were at a rate of 973,000; this is 5.7 percent below the revised February figure of 1,032,000. Authorizations of units in buildings with five units or more were at a rate of 433,000 in March.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) decreased in March compared to February. Multi-family starts were down 44.3% year-over-year in March.

Single-family starts (red) decreased in March and were up 21.2% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse and recovery in single-family starts.

Total housing starts in March were well below expectations, however, starts in January and February were revised up.

I'll have more later …

Monday, April 15, 2024

Tuesday: Housing Starts, Industrial Production

by Calculated Risk on 4/15/2024 07:18:00 PM

In 2023, there were multiple examples of mortgage rates moving up by roughly half a percent in a relatively short amount of time (1-3 weeks). Since the big shift in November, we've only seen one similar example and it was more of a technicality (a sharp drop in rates followed by a correction in early Feb), until today.Tuesday:

...

The culprit was economic data ... this data does not line up with the notion of Fed rate cuts in the near term. It also had an immediate negative impact on the rest of the bond market, including the bonds that most directly dictate mortgage rates.

The average lender is now back into the mid 7s for a top tier, conventional 30yr fixed scenario. [30 year fixed 7.44%]

emphasis added

• At 8:30 AM ET, Housing Starts for March. The consensus is for 1.480 million SAAR, down from 1.521 million SAAR in February.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.5%.

3rd Look at Local Housing Markets in March

by Calculated Risk on 4/15/2024 12:49:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in March

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to March 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the third look at several early reporting local markets in March. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in March were mostly for contracts signed in January and February when 30-year mortgage rates averaged 6.44% and 6.78%, respectively. This is down from the 7%+ mortgage rates in the August through November period (although rates are now back in the 7%+ range again).

...

And a table of March sales.

In March, sales in these markets were down 9.2% YoY. In February, these same markets were up 2.2% year-over-year Not Seasonally Adjusted (NSA).

Sales in most of these markets are down compared to January 2019.

...

Many more local markets to come!

NAHB: Builder Confidence Unchanged in April

by Calculated Risk on 4/15/2024 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 51, unchanged from 51 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Sentiment Unchanged in April

Builder sentiment was flat in April as mortgage rates remained close to 7% over the past month and the latest inflation data failed to show improvement during the first quarter of 2024.

Builder confidence in the market for newly built single-family homes was 51 in April, unchanged from March, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This breaks a four-month period of gains for the index, which nonetheless remains above the key breakeven point of 50.

“With many frustrated buyers back on the fence waiting for interest rates to fall, policymakers can help ease affordability challenges by reducing inefficient regulatory rules that raise housing costs and limit supply,” said NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan.

“April’s flat reading suggests potential for demand growth is there, but buyers are hesitating until they can better gauge where interest rates are headed,” said NAHB Chief Economist Robert Dietz. “With the markets now adjusting to rates being somewhat higher due to recent inflation readings, we still anticipate the Federal Reserve will announce future rate cuts later this year, and that mortgage rates will moderate in the second half of 2024.”

The April HMI survey also revealed that 22% of builders cut home prices this month, down from 24% in March and 36% in December 2023. However, the average price reduction in April held steady at 6% for the 10th straight month. Meanwhile, the use of sales incentives ticked down to 57% in April from a reading of 60% in March.

...

The HMI index charting current sales conditions in April increased one point to 57 and the component gauging traffic of prospective buyers also edged one point higher to 35. The component measuring sales expectations in the next six months fell two points to 60.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased four points to 63, the Midwest gained five points to 46, the South rose one point to 51 and the West registered a four-point gain to 47.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was at the consensus forecast.

Retail Sales Increased 0.7% in March

by Calculated Risk on 4/15/2024 08:37:00 AM

On a monthly basis, retail sales were up 0.7% from February to March (seasonally adjusted), and sales were up 4.0 percent from March 2023.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for March 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.6 billion, up 0.7 percent from the previous month, and up 4.0 percent above March 2023. ... The January 2024 to February 2024 percent change was revised from up 0.6 percent to up 0.9 percent.

emphasis added

Click on graph for larger image.

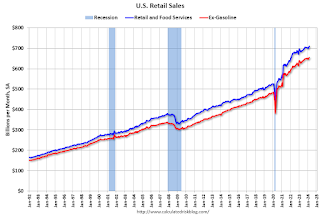

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in March.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.4% on a YoY basis.

The increase in sales in March was above expectations, and, sales in January and February were revised up.

The increase in sales in March was above expectations, and, sales in January and February were revised up.

Housing April 15th Weekly Update: Inventory up 2.6% Week-over-week, Up 29.6% Year-over-year

by Calculated Risk on 4/15/2024 08:01:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, April 14, 2024

Monday: Retail Sales, NY Fed Mfg, Homebuilder Survey

by Calculated Risk on 4/14/2024 11:57:00 PM

Weekend:

• Schedule for Week of April 14, 2024

Monday:

• At 8:30 AM ET, Retail sales for March is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of -9.0, up from -20.9.

• At 10:00 AM, The April NAHB homebuilder survey. The consensus is for a reading of 51, unchanged from 51. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 14 and DOW futures are up 78 (fair value).

Oil prices were up over the last week with WTI futures at $85.66 per barrel and Brent at $90.45 per barrel. A year ago, WTI was at $83, and Brent was at $87 - so WTI oil prices are up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.61 per gallon. A year ago, prices were at $3.65 per gallon, so gasoline prices are down $0.04 year-over-year.

Saturday, April 13, 2024

By Request: Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 4/13/2024 09:25:00 PM

Note: I used to post this monthly, but I stopped during the COVID-19 pandemic. I've received a number of requests lately to post this again, so here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

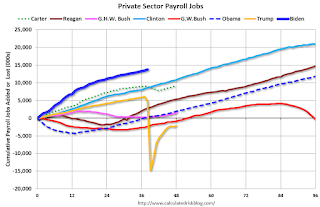

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter, George H.W. Bush and Trump only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr. Clinton (light blue) served for eight years without a recession. And there was a pandemic related recession in 2020.

First, here is a table for private sector jobs. The previous top two private sector terms were both under President Clinton.

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Biden | 13,7351 |

| Clinton 1 | 10,876 |

| Clinton 2 | 10,094 |

| Obama 2 | 9,926 |

| Reagan 2 | 9,351 |

| Carter | 9,039 |

| Reagan 1 | 5,363 |

| Obama 1 | 1,907 |

| GHW Bush | 1,507 |

| GW Bush 2 | 443 |

| GW Bush 1 | -820 |

| Trump | -2,192 |

| 1After 38 months. | |

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

Private sector employment increased by 9,039,000 under President Carter (dashed green), by 14,714,000 under President Reagan (dark red), 1,507,000 under President G.H.W. Bush (light purple), 20,970,000 under President Clinton (light blue), lost 377,000 under President G.W. Bush, and gained 11,833,000 under President Obama (dark dashed blue). During Trump's term (Orange), the economy lost 2,135,000 private sector jobs.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However, the public sector declined significantly while Mr. Obama was in office (down 263,000 jobs). During Trump's term, the economy lost 528,000 public sector jobs.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Biden | 1,4821 |

| Reagan 2 | 1,438 |

| Carter | 1,304 |

| Clinton 2 | 1,242 |

| GHW Bush | 1,127 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Clinton 1 | 692 |

| Obama 2 | 447 |

| Reagan 1 | -24 |

| Trump | -528 |

| Obama 1 | -710 |

| 1After 36 months. | |