Isaac Asimov predictions from 1981

1985 — World oil production will fall below world needs

1990 — North America will no longer be a reliable source for food export

1995 — The nations of the world will meet (unwillingly) in a Global Congress to tackle seriously the problems of population, food, and energy.

2000 — Under global sponsorship, the construction of solar power stations in orbit about the earth will have begun.

2005 — A mining station will be in operation on the moon.

2010 — World population will have peaked at something like 7 billion.

2015 — The dismantling of the military machines of the world will have made international war impractical.

2020– The flow of energy from solar-power space stations will have begun. Nuclear fusion stations will be under construction.

2025 — The Global Congress will be recognized as a permanent institution. The improvement in communications will have developed a world “lingua franca,” which will be taught in schools.

2030 — The use of microcomputers and electronic computers will have revolutionized education, produced a global village, and prepared humanity for the thorough exploration of the solar system and the plans for eventual moves toward the stars.

Two of those are really good! They are from The Book of Predictions, by David Wallechinsky, Amy Wallace, and Irving Wallace.

A subculture that is German?

German far-left vandals break through police lines and run for Tesla’s Gigafactory, hoping to disrupt production.

These people clearly hate both fossil fuel cars and electric cars. They are modern-day luddites pic.twitter.com/5aVD6MeNZ3

— Visegrád 24 (@visegrad24) May 10, 2024

And here are some remarks on AI dating.

Friday assorted links

Battery Arbitrage

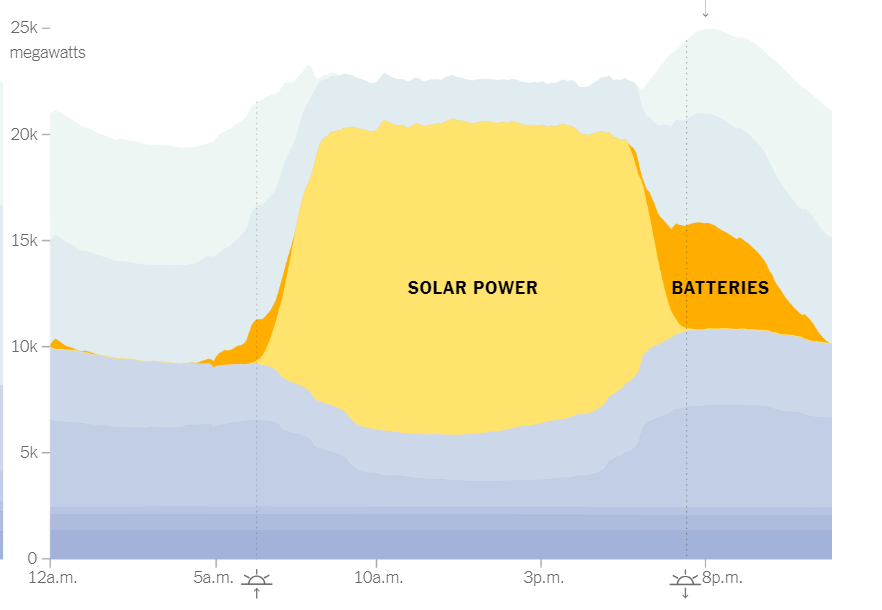

Solar is powering a large share of California’s energy needs during the day and batteries are now powering a significant share at night.

NYTimes: Since 2020, California has installed more giant batteries than anywhere in the world apart from China. They can soak up excess solar power during the day and store it for use when it gets dark.

Those batteries play a pivotal role in California’s electric grid, partially replacing fossil fuels in the evening. Between 7 p.m. and 10 p.m. on April 30, for example, batteries supplied more than one-fifth of California’s electricity and, for a few minutes, pumped out 7,046 megawatts of electricity, akin to the output from seven large nuclear reactors.

California’s electricity deregulation had a rocky start but notice that it is paying off today because what is happening is that prices are low at mid-day when the sun is shining and they rise in the evening. Power companies profit by using batteries to arbitrage these prices differences. Thus, power companies have been willing to make huge investments in battery technology.

*Hoop Atlas*

The author is Kirk Goldsberry, and the subtitle is Mapping the Remarkable Transformation of the NBA. I enjoyed this book very much, and the visual are excellent. The prose reads well, but also sticks to the analytical. Excerpt:

Over 80 percent of NBA 3s involve an assist. Typical 3-pointers are catch-and-shoot attempts that punctuate playmaking sequences that occur far away from the actual shot location, and that’s where James comes in. James is the NBA’s all-time leader in assisted 3s. He may never surpass John Stockton for total assists, but James has had his hand in more 3s than anyone else, period. He’s assisted on more 3s than Curry has made, and he’s had an outsized impact as a producer of corner 3. As a playmaker, James has extended what [Bruce] Bowen and the Spurs began.

…Six of the 10 most prolific corner-3 shooters of all time have been assisted by James, and that’s no coincidence.

…On the list of the NBA’s greatest scorers ever, James is the best playmaker, and it’s not close.

And this:

MJ was a durable player by any reasonable standard, but he ended up playing fewer career minutes than Jason Terry.

Recommended.

TC on less-skilled immigrants not being a fiscal burden

You heard from Alex on that topic recently, here is my contribution in the form of a Bloomberg column:

According to new research from economists at the University of Oregon and the University of St. Gallen in Switzerland, new low-skilled immigrants to the US are a net fiscal plus — each adding an estimated $750 a year to government coffers at the federal, state and local levels. And their contribution to the entire economy is likely larger still.

These new measures do not deny the standard assessments of the potential fiscal costs of immigrants. Rather, they consider an additional positive factor: namely, that low-skilled immigrants enable native workers to move into higher-wage jobs, and in some cases to work more hours. That may occur through a number of channels, some of them highly complex and hard to measure, but most simply recall Adam Smith’s maxim that the division of labor is limited by the extent of the market.

To view this more concretely, consider working parents who would choose more demanding and higher-paying jobs if cheaper and more convenient child care, which typically requires only a high school diploma, were available. If a new immigrant provided that care, those parents would be able to earn more money — and would pay more taxes.

That is an obvious and relatively visible story. A more indirect effect involves businesses. When cheaper labor is available, they may make bigger and more ambitious plans, which also has benefits for government revenue. In any case, the indirect fiscal effects of the immigrants will be more positive than the direct effects.

Recommended, Alex and I agree (and without consultation).

The manufacture of credibility?

Israel and Iran bombed each other like three weeks ago and now oil prices are low enough that the SPR [Strategic Petroleum Reserve] is looking at buying

That is from Matthew Zeitlin. One read of the current equilibrium is that both Iran and Israel have shown they really do not want to escalate, or perhaps are not able to escalate. Arguably that was less obvious two months ago.

It is hard to establish such credibility unless things get really hairy, and then both parties pull back from the brink.

I don’t think that is the only way to read recent events. An alternative would be “We are witnessing widening concentric circles of violence, and the next round is going to be a doozy.”

Maybe, but so far markets seem to believe the more optimistic scenario.

Thursday assorted links

1. Berkeley festival of smart internet writers, you can apply to go.

2. Lyman Stone on urban density and fertility.

3. Joseph Heath articles, some about Canada.

4. Using social contagion to improve health outcomes in Honduras.

5. Can tech solve the problem of inequality?

6. The economics of Ukrainian strikes on Russian oil refineries.

The US has Low Electricity Prices

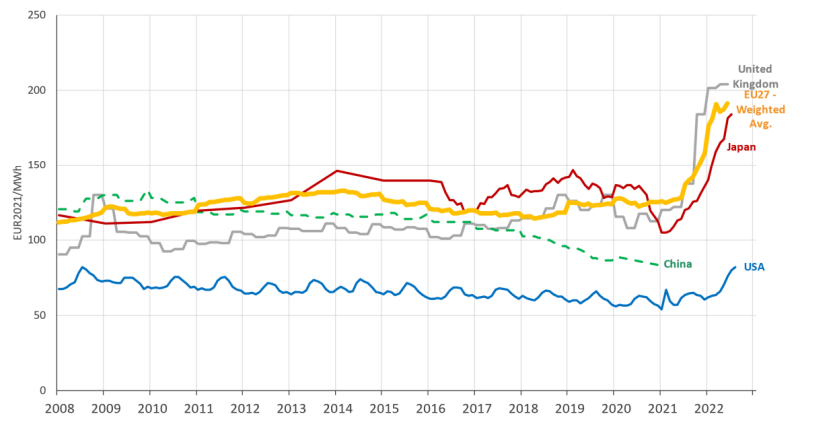

The US has some of the lowest electricity prices in the world. Shown below are industrial retail electricity prices in EU27, USA, UK, China and Japan. Electricity is critical for AI compute, electric cars and more generally reducing carbon footprints. The US needs to build much more electricity infrastructure, by some estimates tripling or quadrupling production. That’s quite possible with deregulation and permitting reform. I am pleased to learn, moreover, that we are starting from a better base than I had imagined.

Did World War II pull America out of the Great Depression?

Maybe by less than people had thought, here is a new ReStat paper by Gillian Brunet:

I use newly-digitized contract data on U.S. war production spending over 1940-1945 to analyze the macroeconomic effects of U.S. military spending in World War II. I find personal income multipliers of 0.34 over two years and 0.49 over three years. Personal income multipliers may substantially understate GDP multipliers, perhaps by as much as 50%. Employment estimates imply costs per job-year over the same time horizons of $405,013 and $232,268 in 2015 dollars, suggesting job creation was limited. I also find evidence of negative scale effects: larger positive spending shocks are associated with systematically smaller multiplier estimates.

Via Alexander Berger. The author’s title is “Stimulus on the Home Front: The State-Level Effects of WWII Spending.”

GPT-4 beats psychologists on a new test of social intelligence

There were significant differences in SI between psychologists and AI’s ChatGPT-4 and Bing. ChatGPT-4 exceeded 100% of all the psychologists, and Bing outperformed 50% of PhD holders and 90% of bachelor’s holders. The differences in SI between Google Bard and bachelor students were not significant, whereas the differences with PhDs were significant; Where 90% of PhD holders excel on Google Bird.

That is from a new paper by Nabil Saleh Sufyan, et.al. In the “good ol’ days” we thought that was the task where AI would never have much of a fighting chance. Now the bets models are just outright beating the humans.

Note that all the subjects were men. Via Christopher Altman.

Wednesday assorted links

1. “Authors who were perceived as female responded at similar rates regardless of the pronouns in the requester’s email. Authors who were perceived as male were less likely to respond to emails from requesters with they/them pronouns than all other conditions. This work finds that people who use they/them pronouns experience bias in real-world situations due solely to their gender pronouns.” Link here.

2. U.S. murder rates are plummeting.

3. Sam Hammond’s 95 theses on AI, not my views but interesting.

4. Do sperm whale songs have an alphabet of sorts? (NYT)

5. Preference falsification at Dartmouth?

6. “AlphaFold 3 predicts the structure and interactions of all of life’s molecules.”

7. More on Luka.

*Scarce and Valuable Economic Tracts*

Three big volumes, about 1800 pp., these books reprint the true classics behind the origins of economic thought. These are the best works of economics published before Adam Smith, and essentially they founded economic science. The originals were edited by the classical economist John Ramsay McCulloch, but they now have been reprinted by Classical Liberal Press. I don’t know of any comparably easy way to read these works, or anything close.

Here is one volume, here is another, here is a third. Each is priced below $20, definitely recommended.

FTX Customers Poised to Recover All Funds Lost in Collapse

Some of the recoveries stemmed from successful investments that Mr. Bankman-Fried made during his FTX tenure. In 2021, the company had put $500 million into the artificial intelligence company Anthropic. A boom in the A.I. industry made those shares much more valuable. This year, Mr. Ray’s team sold about two-thirds of FTX’s stake for $884 million.

FTX also reached a deal to recover more than $400 million from Modulo Capital, a hedge fund that Mr. Bankman-Fried had financed. And lawyers for FTX filed lawsuits to claw back funds from former company executives and others, including Mr. Bankman-Fried’s parents.

Here is the full NYT story, noting that account holders did not receive (significant) gains in the value of bitcoin that otherwise would have accrued.

IQ matters more at the very top

We document a convex relationship between earnings rank and cognitive ability for men in Finland and Norway using administrative data on over 350,000 men in each country: the top earnings percentile score on average 1 standard deviation higher than median earners, while median earners score about 0.5 standard deviation higher than the bottom percentile of earners. Top earners also have substantially less variation in cognitive test scores. While some high-scoring men are observed to have very low earnings, the lowest cognitive scores are almost absent among the top earners. Overall, the joint distribution of earnings rank and ability is very similar in Finland and Norway. We find that the slope of the ability curve across earnings ranks is steepest in the upper tail, as is the slope of the earnings curve across cognitive ability. The steep slope of the ability curve across the top earnings percentiles differs markedly from the flat or declining slope recently reported for Sweden.

That is from a new paper by Bernt Bratsberg, Ole Rogeberg, and Marko Terviö. You may recall that Daniel Gross and I made a similar claim in our book Talent, namely that the very top performers in virtually any field are extremely smart, even if the field is not an intellectual one in the traditional sense.