Organize your life?

Ben Lang didn’t expect to get so much hate just for being organized. For the past three years, he and his wife, Karen-Lynn Amouyal, have been using Notion, a popular software tool, to optimize their household and relationship. His version of the tool, commonly used by businesses to manage complex projects, functions like a souped-up Google Doc, with sections for a grocery list, to-do lists and details of upcoming trips.

More unusual is a section Mr. Lang, a venture capital investor who previously worked at Notion, created about principles (“what’s important to us as a couple”). Another section, called “Learnings,” outlines things the couple have discovered about each other, such as their love languages and Myers-Briggs test results. There’s a list of friends they want to set up on dates. They also maintain a log of memories from their date nights. Mr. Lang, 30, was so proud of the creation that last month, he started promoting a template of the setup to others. “My wife and I use Notion religiously to manage our day-to-day life,” he wrote on X. “I turned this into a template, let me know if you’d like to see it!”

Here is more from Erin Griffith at the NYT.

Jerry Seinfeld Duke commencement speech

Just to confirm…

Just to confirm:

– Climate change is unprecedented risk

– Mass adoption of EVs is vital

– Adoption has slowed bc lack of low-priced options

– US companies unable/unwilling to make low-priced EVs

– China is global leader in low-priced EVs

– US to hit China with 100% EV tariffs— John Arnold (@JohnArnoldFndtn) May 12, 2024

Sunday assorted links

1. Is it people on the Left who have a better sense for the visual arts?

2. Boat painting regulatory arbitrage?

4. Gideon Lewis-Kraus samples flying cars (New Yorker).

5. The popular cover song is dead.

6. 15 percent of the Georgian population was in the streets last night.

7. Immigration and the housing crisis in Australia.

8. Autism and the internet will defeat the monoculture, by Ruxandra.

There is simply no good reason for such a ruling

A top Wall Street regulator has proposed outlawing election betting in the U.S. derivatives markets, with officials warning that the activity poses a threat to the sanctity of American elections.

The Commodity Futures Trading Commission, which is charged with regulating the vast and complex derivatives markets, voted 3-2 on Friday to issue a new rule proposal that would ban so-called event contracts that effectively act as wagers on political elections. The plan would also prohibit those contracts related to sporting events and even awards ceremonies like the Oscars.

And from the horse’s mouth:

“Contracts involving political events ultimately commoditize and degrade the integrity of the uniquely American experience of participating in the democratic electoral process,” CFTC Chair Rostin Behnam said. “Allowing these contracts would push the CFTC, a financial market regulator, into a position far beyond its Congressional mandate and expertise. To be blunt, such contracts would put the CFTC in the role of an election cop.”

Behnam was joined in supporting the proposal by fellow Democratic Commissioners Kristin Johnson and Christy Goldsmith Romero.

Here is the full Politico article. How can you put such people in charge of things? What else do they want to stop us from doing? Is it so difficult for them to imagine a world where the election forecasts we can find on Predictit — among other sources — simply continue and that is perfectly fine, as it has been for years?

Ryan Bourne’s *The War on Prices*

The subtitle is

Was inflation’s recent spike exacerbated by corporate greed? Do rent controls really help the needy? Are U.S. health care prices set in a Wild West marketplace? Do women get paid less than men for the same work, and do they pay more than men for the same products? The War on Prices is an eye-opening book that answers all these burning questions and more, as top economists debunk popular misconceptions about inflation, prices, and value.

The economics of Apple share repurchase

That is the topic of my latest Bloomberg column, and here is the basic setting:

Apple unveiled a record stock buyback plan last week even as it increased its dividend by 4%, to 25 cents per share. That made the market happy, and shares in the company are up about 10% since the announcement.

And this:

Given that the market approved of Apple sending more money outside the company, the market must think Apple shareholders are better at allocating funds than Apple is. Apple, to its credit, has realized this. Of course Apple still has plenty of cash on hand and some very strong market positions, most of all for its iPhones. So it’s not quite a case of the market telling Apple management it doesn’t know what it’s doing. Instead, the market is seeing that Apple is wise enough to rethink its most marginal plans. That is bullish for the overall value of Apple.

There is another aspect to this story that suggests a relatively bright future for Apple. By buying back shares, Apple management is signaling that those shares are underpriced. That means the company is relatively optimistic about the plans it already has underway, as it is willing to hold an extra concentration of equity in those plans. It is not trying to pawn off those returns on unsuspecting others, as a dishonest company might do if the whole enterprise were rotten. The market is rewarding this refreshing sign of honesty.

So the signaled skepticism about new, marginal plans for the most doubtful projects is combined with optimism about existing, presumably promising infra-marginal plans, to use economic terminology. No, Apple is saying, we cannot take over the world, but what we have in the works will go well. And the market believes it.

If you are worried about Big Tech taking over the world but want your favorite products to keep improving, all this is pretty positive news. It is a sign that Big Tech’s influence has peaked — but that its core products will remain popular and likely will get better.

I remain happy with my iPad Pro, but I am not sure how much better it is going to get.

Saturday assorted links

From the era of insane economic policy

My dad always used to say that the way you build wealth is by building equity in your home. My housing plan would help Americans achieve homeownership by giving households $400 a month for two years when they buy their first home.

That is from President Biden.

Henry Oliver’s *Second Act* is coming out in the UK

An excellent book, here is the UK Amazon link, I am not sure of the U.S. plans. The subtitle is What Late Bloomers Can Tell You About Success and Reinventing Your Life.

Here is one excerpt:

What this showed is that processing speed (matching numbers and symbols) peaks much earlier than working memory (unfamiliar shapes and reciting lists of numbers). These are both aspects of fluid intelligence, but they peak at different times. The idea that fluid intelligence is one thing and declines early isn’t quite right. There are many aspects to intelligence and they peak at different ages throughout our lives. The authors of the study say: ‘Not only is there no age at which humans are performing at peak at all cognitive tasks, there may not be an age at which humans are at peak on most cognitive tasks.’

One of the very best books written on talent. Here is a Dan Rothschild thread on the book. Dan writes: “…this isn’t a self-help book per se. But it provides exceptional context for thinking about aging, talent, and finding purpose in life, through the lives of people who led extraordinary lives in unpredictable ways.” Here is Henry Oliver on Twitter.

Isaac Asimov predictions from 1981

1985 — World oil production will fall below world needs

1990 — North America will no longer be a reliable source for food export

1995 — The nations of the world will meet (unwillingly) in a Global Congress to tackle seriously the problems of population, food, and energy.

2000 — Under global sponsorship, the construction of solar power stations in orbit about the earth will have begun.

2005 — A mining station will be in operation on the moon.

2010 — World population will have peaked at something like 7 billion.

2015 — The dismantling of the military machines of the world will have made international war impractical.

2020– The flow of energy from solar-power space stations will have begun. Nuclear fusion stations will be under construction.

2025 — The Global Congress will be recognized as a permanent institution. The improvement in communications will have developed a world “lingua franca,” which will be taught in schools.

2030 — The use of microcomputers and electronic computers will have revolutionized education, produced a global village, and prepared humanity for the thorough exploration of the solar system and the plans for eventual moves toward the stars.

Two of those are really good! They are from The Book of Predictions, by David Wallechinsky, Amy Wallace, and Irving Wallace.

A subculture that is German?

German far-left vandals break through police lines and run for Tesla’s Gigafactory, hoping to disrupt production.

These people clearly hate both fossil fuel cars and electric cars. They are modern-day luddites pic.twitter.com/5aVD6MeNZ3

— Visegrád 24 (@visegrad24) May 10, 2024

And here are some remarks on AI dating.

Friday assorted links

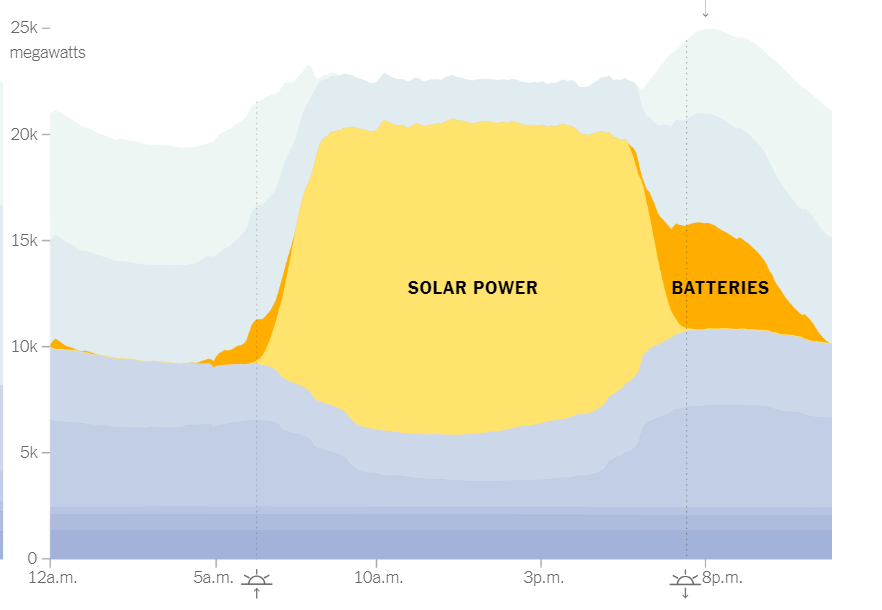

Battery Arbitrage

Solar is powering a large share of California’s energy needs during the day and batteries are now powering a significant share at night.

NYTimes: Since 2020, California has installed more giant batteries than anywhere in the world apart from China. They can soak up excess solar power during the day and store it for use when it gets dark.

Those batteries play a pivotal role in California’s electric grid, partially replacing fossil fuels in the evening. Between 7 p.m. and 10 p.m. on April 30, for example, batteries supplied more than one-fifth of California’s electricity and, for a few minutes, pumped out 7,046 megawatts of electricity, akin to the output from seven large nuclear reactors.

California’s electricity deregulation had a rocky start but notice that it is paying off today because what is happening is that prices are low at mid-day when the sun is shining and they rise in the evening. Power companies profit by using batteries to arbitrage these prices differences. Thus, power companies have been willing to make huge investments in battery technology.

*Hoop Atlas*

The author is Kirk Goldsberry, and the subtitle is Mapping the Remarkable Transformation of the NBA. I enjoyed this book very much, and the visual are excellent. The prose reads well, but also sticks to the analytical. Excerpt:

Over 80 percent of NBA 3s involve an assist. Typical 3-pointers are catch-and-shoot attempts that punctuate playmaking sequences that occur far away from the actual shot location, and that’s where James comes in. James is the NBA’s all-time leader in assisted 3s. He may never surpass John Stockton for total assists, but James has had his hand in more 3s than anyone else, period. He’s assisted on more 3s than Curry has made, and he’s had an outsized impact as a producer of corner 3. As a playmaker, James has extended what [Bruce] Bowen and the Spurs began.

…Six of the 10 most prolific corner-3 shooters of all time have been assisted by James, and that’s no coincidence.

…On the list of the NBA’s greatest scorers ever, James is the best playmaker, and it’s not close.

And this:

MJ was a durable player by any reasonable standard, but he ended up playing fewer career minutes than Jason Terry.

Recommended.